Invest in the 20-25 highest quality global businesses at a reasonable price

Businesses that meet three criteria:

These companies usually:

Do not speculate or invest on the basis of macroeconomic expectations:

The above Don’ts reduce the sectors and universe of investable companies drastically, limiting the investment universe to very few companies – the global winners (Nartex does not invest in banks, insurance companies, utilities, automotive, mining, oil etc.)

Historical data, theory and experience confirm this.

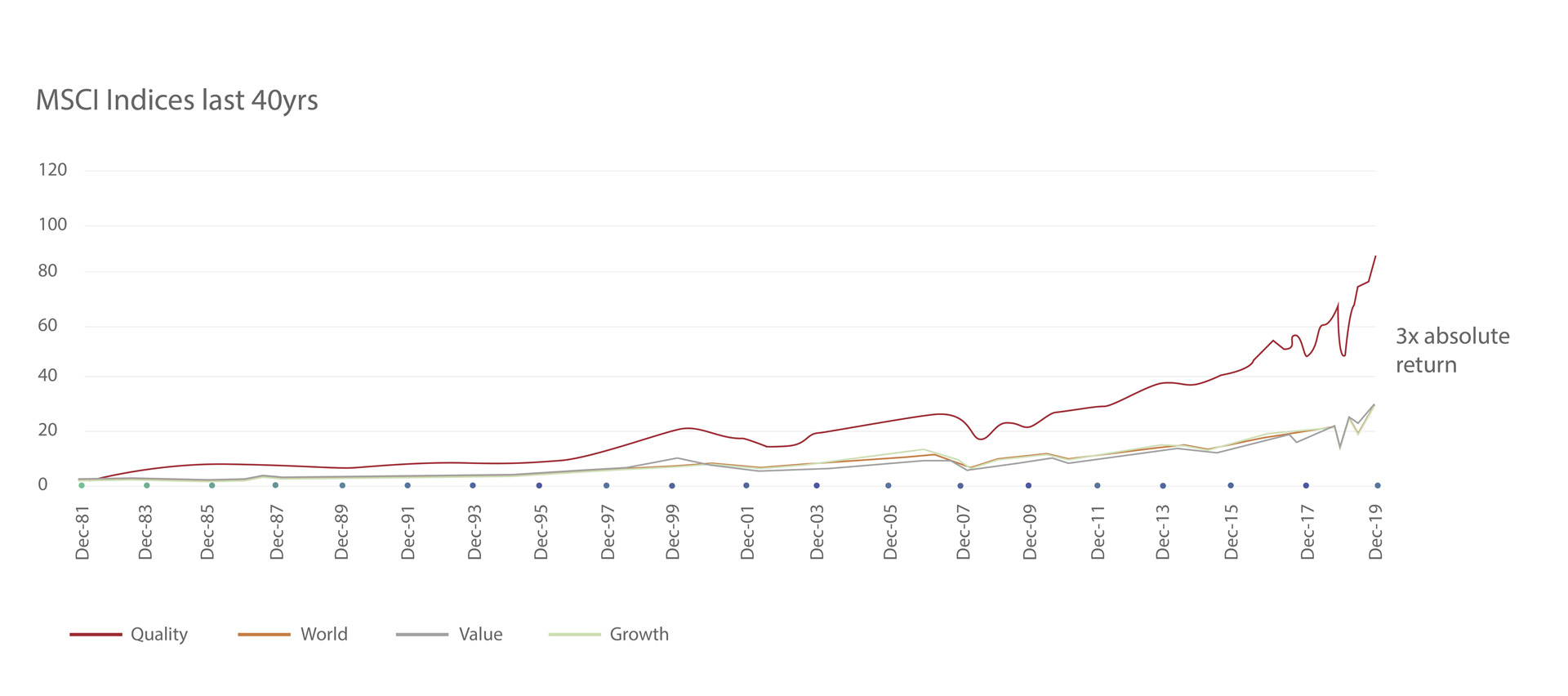

Empirically, the MSCI World Quality Index (a crude way of identifying quality) has delivered almost 3x more absolute return than the global index, the value index or the growth index over the last 40 years.

Past performance is not indicative of future results. Source: Bloomberg.

Register to learn more.